Get ready to be amazed by the numbers that define India’s washing machine market.

From market shares to top-selling models, we’ve gathered the most intriguing statistics that shed light on this essential household appliance’s impact in the country.

Table of Contents

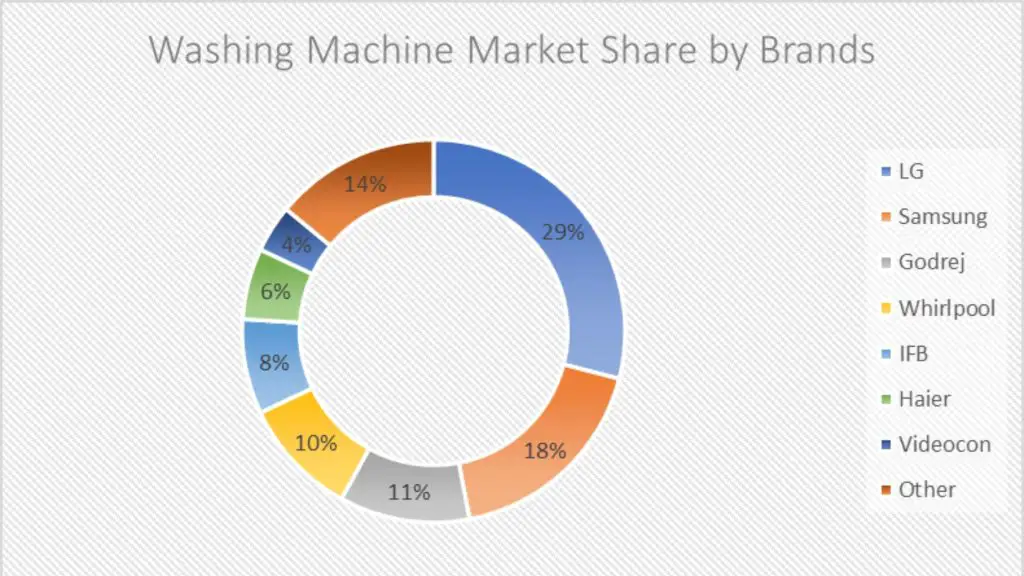

Washing Machine Market Share by Brands

- LG: 29%

- Samsung: 18%

- Godrej: 11%

- Whirlpool: 10%

- IFB: 8%

- Haier: 6%

- Videocon: 4%

- Others: 14%

Key Points

- Samsung India experienced a 30% growth in washing machine sales in the First Half of 2023.

- The company sold 2 million units in the First Half of 2023, up from 1.5 million in the same period last year.

- LG India’s washing machine sales grew by 25% in the First Half of 2023.

- The company sold 1.5 million units in the First Half of 2023, up from 1.2 million in the same period last year.

Pricing and Manufacturing Costs

- The average selling price of a washing machine in India is approximately Rs. 20,000.

- The average cost of manufacturing a washing machine is around Rs. 10,000.

Market Projections

- Indian Washing Machine Market Value (2022): US$ 2190.5 Mn.

- Estimated Market Value (2029): Almost US$ 2973 Mn.

- Projected CAGR (2023-2029): 4.46%

Market Segment Growth

- Fully automatic segment contribution: 60% of the overall washing machine market

- Fully automatic segment growth rate: Fastest growing due to consumer convenience

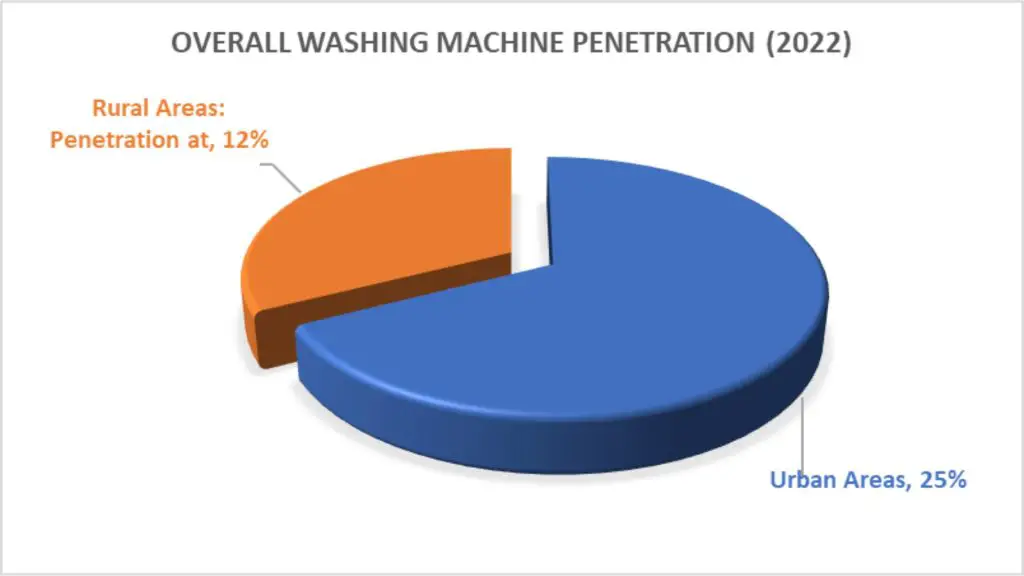

Penetration and Demographics

- Overall Washing Machine Penetration (2022): 18% of households

- Urban Areas: Penetration at 25%

- Rural Areas: Penetration at 12%

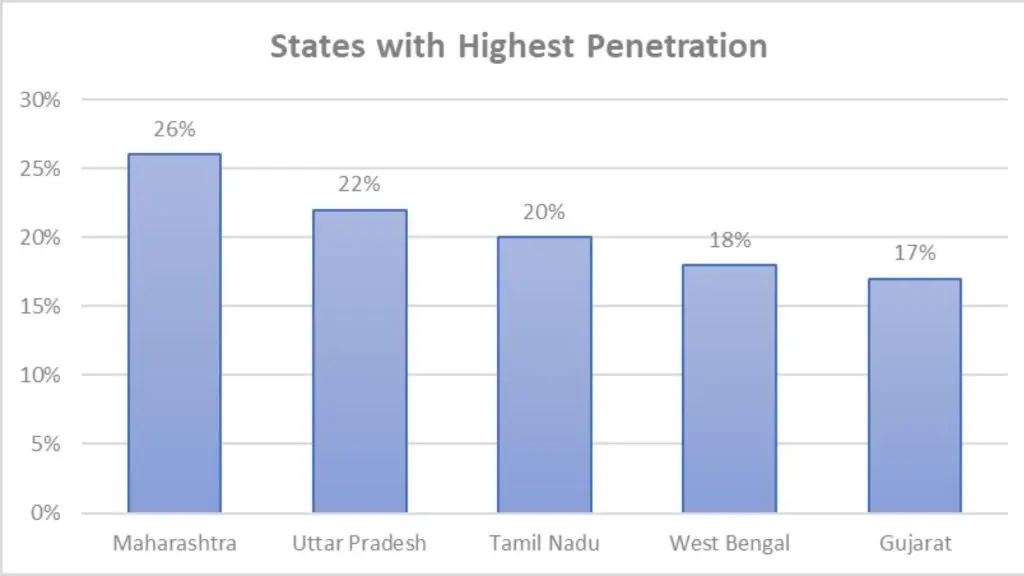

Regional Penetration

States with Highest Penetration:

- Maharashtra: 26%

- Uttar Pradesh: 22%

- Tamil Nadu: 20%

- West Bengal: 18%

- Gujarat: 17%

States with Lowest Penetration:

- Bihar: 8%

- Jharkhand: 7%

- Odisha: 6%

- Assam: 5%

- Meghalaya: 4%

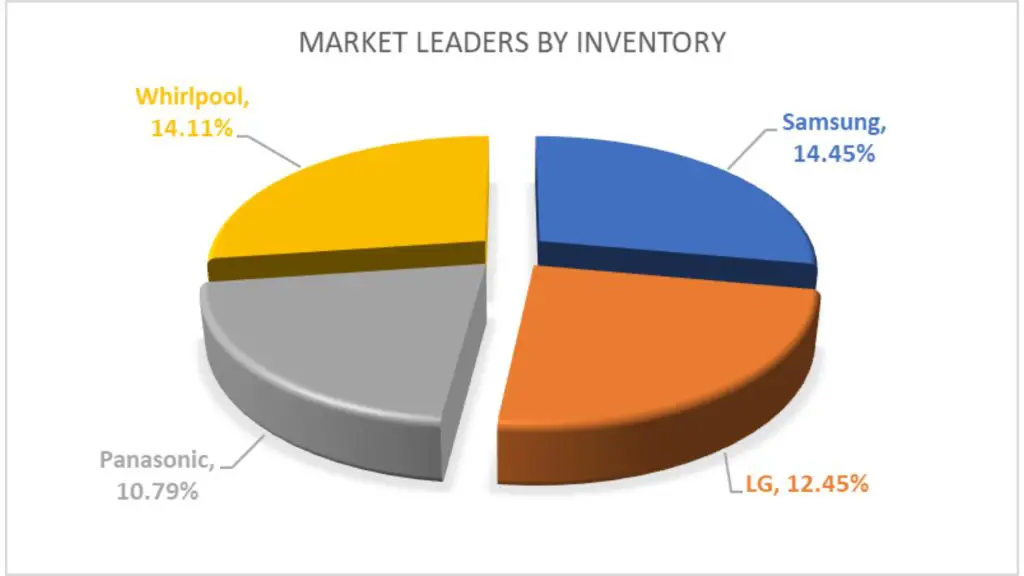

Market Leaders by Inventory

- Samsung: 14.45% of total inventory

- LG: 12.45% of total inventory

- Panasonic: 10.79% of total inventory

- Whirlpool: 14.11% of total inventory

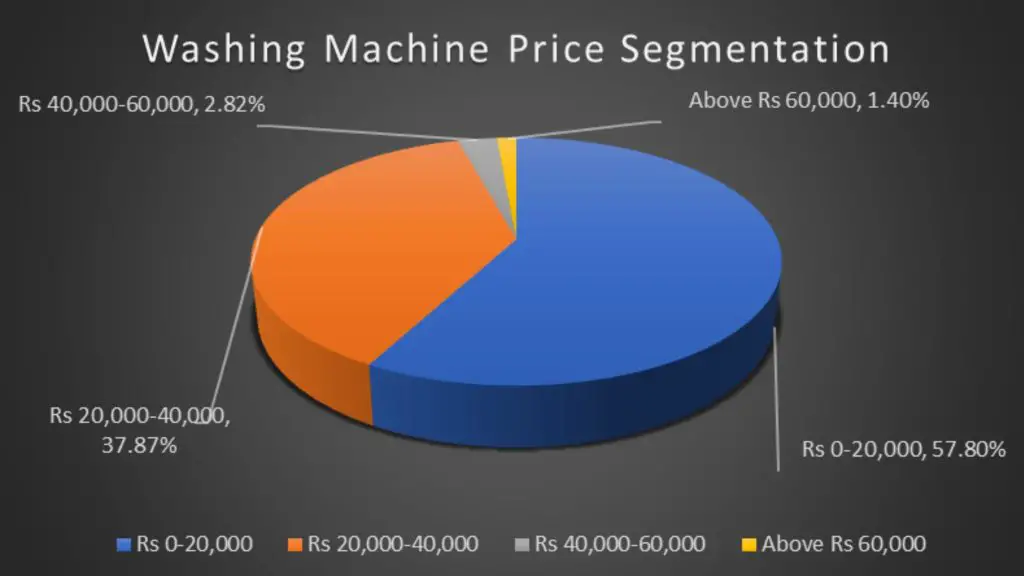

Price Segmentation

- Washing machines priced between Rs 0-20,000: 57.80%

- Washing machines priced between Rs 20,000-40,000: 37.87%

- Washing machines priced between Rs 40,000-60,000: 2.82%

- Washing machines priced above Rs 60,000: 1.4%

Type of Washing Machines dominating the market

- Fully automatic top load machines: 43.5% of total inventory

- Semi-automatic top load machines: 8.4% of total inventory

- Fully automatic front load machines: 23.9% of total inventory

Market Performance

- Decline in value shipments (2022 vs 2021): -10.1%

- CAGR in 2022 over the period of 2017: 1.75%

Import Trends

- Import factor in Washing Machine Market (2022): 2.5 vs. 2.94 in 2017

- Top exporting countries (2022): China, Germany, Thailand, Italy, Türkiye

- China’s market share (2022): 41.17% with a shipment value of 52.08 million USD

- China’s competitive advantage: Lower average market price

Key Information of leading brands

- In March 2023, Samsung released two new washing machines in India that you don’t have to fully control. They start at INR 15,000 (around $190). These machines have useful features like a timer to start later, a soak option, and a lock to keep kids safe.

- In May 2023, Godrej Appliances teamed up with Amazon to introduce special washing machines. These unique models are found only on Amazon and have cool things like a 6.5kg size, a spin that goes really fast (1400 RPM), and a lock to keep kids safe.

- In February 2023, Whirlpool announced an investment of ₹115 crores (~$15 million) for a new manufacturing plant in Telangana with an annual capacity of 500,000 units, set to be operational by the end of 2023. In February 2023, Whirlpool India announced an investment of ₹115 crore (approx. $15 million) for a new manufacturing plant for front-load washing machines in Telangana. The plant is set to be operational by the end of 2023, with an annual capacity of 500,000 units.

As the washing machine whirls into every corner of India, these statistics capture the dynamics of a booming market. From technological innovations to regional disparities, every number tells a story of convenience, competition, and progress.

Disclaimer: All figures are based on the provided data and may be subject to change.

Remember, these statistics are just the tip of the iceberg when it comes to India’s washing machine market. Stay tuned for more trends and surprises in the laundry arena.

You May Also Like

- 50+ Washing Machine Statistics worth reading

- Portable Washer Energy Consumption: Save up to 50%

- How to Calculate Power Consumption of Washing Machine?

- How to Calculate Washing Machine Capacity? (With formula)

- How does an automatic washing machine choose water level?

- What’s the Average Height of a Washing Machine?